Introduction: NVIDIA’s stock

NVIDIA is a leading company in the field of visual computing technologies and the inventor of the graphic processing unit, or GPU¹. The company’s products are used for various applications, such as gaming, artificial intelligence, high performance computing, and virtual reality. NVIDIA has been growing rapidly in the past two decades, as it has expanded its markets and innovated its technologies.

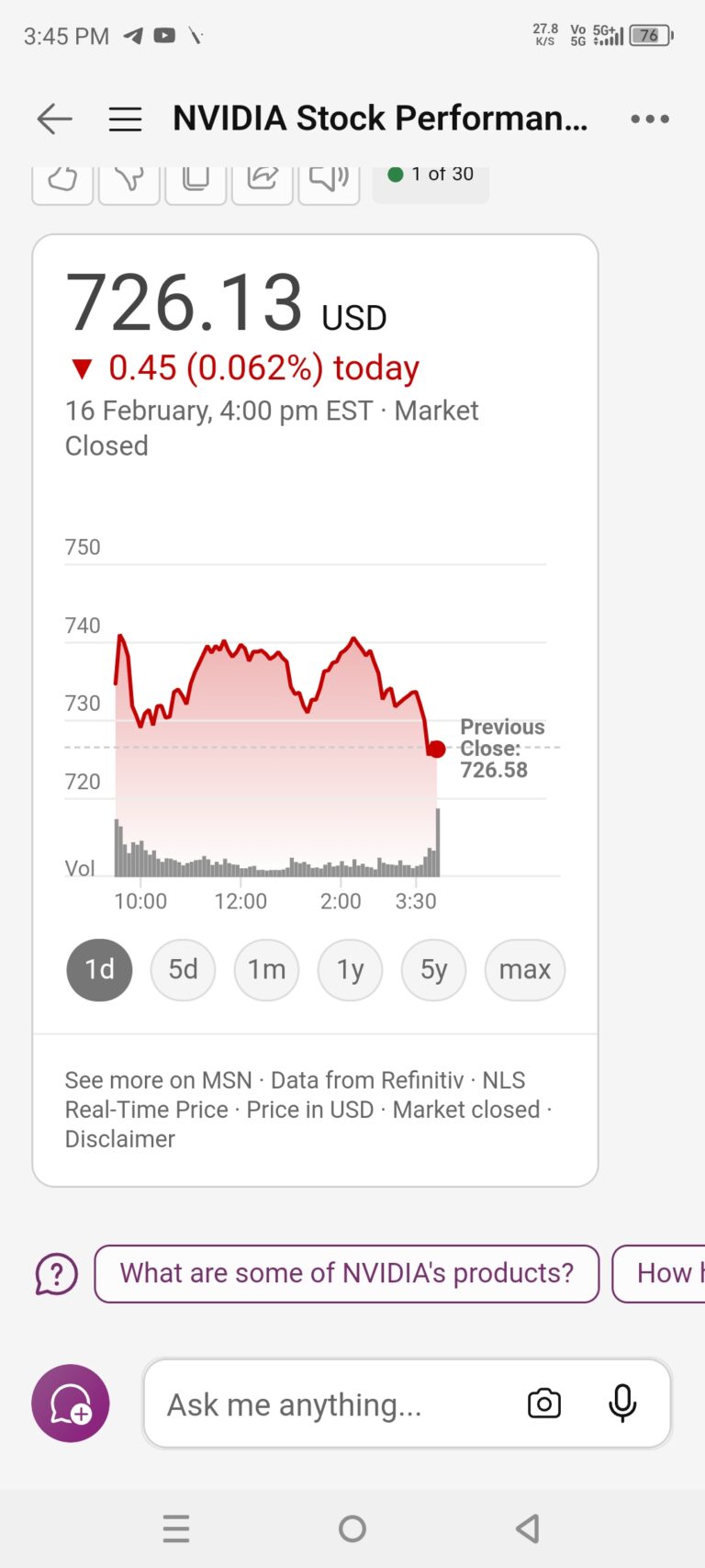

According to the historical data from Yahoo Finance², NVIDIA’s stock price was $1.2540 per share on January 3, 2000, the first trading day of the year. If you had invested $5,000 in NVIDIA on that day, you would have bought 3,986 shares of the company. As of February 16, 2024, the latest closing price for NVIDIA was $726.13 per share². Therefore, your 3,986 shares would be worth $2,894,545.18 as of that

date. This means that your investment would have grown by 57,790.9% in 24 years, or by an average of 34.98% per year.

However, this calculation does not take into account the dividends and stock splits that NVIDIA has issued over the years. NVIDIA has paid quarterly dividends since 2012, and has increased its dividend amount every year since then³. The company has also split its stock four times in its history: a 2-for-1 split in 2000, a 2-for-1 split in 2006, a 4-for-1 split in 2007, and a 4-for-1 split in 2021². These events affect the number of shares you would have owned and the amount of dividends you would have received over time.

To account for these factors, we need to use the adjusted closing price, which reflects the impact of dividends and stock splits on the stock price. According to Yahoo Finance², the adjusted closing price for NVIDIA on January 3, 2000 was $0.7091 per share. Therefore, your $5,000 investment would have bought 7,051 shares of the company on that day. As of February 16, 2024, the adjusted closing price for NVIDIA was $726.13 per share². Therefore, your 7,051 shares would be worth $5,120,313.63 as of that date. This means that your investment would have grown by 102,306.3% in 24 years, or by an average of 36.67% per year.

Here's a comparison of key aspects of NVIDIA’s stock performance from 2005 to early 2024

Stock Price Performance: NVIDIA’s stock price has experienced significant growth over the past two decades, driven by strong financial performance and increasing demand for its products in various markets. The stock has undergone periods of volatility, but the overall trend has been upward. However, specific figures would need to be looked up for precise comparisons.

Market Capitalization: NVIDIA’s market capitalization has grown substantially since 2005. As the company has expanded into new markets and demonstrated strong financial performance, investors have valued the company more highly over time

Financial Performance: NVIDIA’s financial performance has generally been strong over the years, with revenue and earnings increasing significantly. This growth has been driven by various factors, including the increasing adoption of GPUs in gaming, data centers, AI, and other applications.

Dividends and Share Buybacks: Historically, NVIDIA has not paid dividends, instead choosing to reinvest its profits into research and development or strategic acquisitions. However, the company has occasionally initiated share buyback programs to return value to shareholders.

Dividends and Share Buybacks: Historically, NVIDIA has not paid dividends, instead choosing to reinvest its profits into research and development or strategic acquisitions. However, the company has occasionally initiated share buyback programs to return value to shareholders.

Corporate Developments: Over the years, NVIDIA has made strategic acquisitions, partnerships, and investments to strengthen its position in key markets. Additionally, the company has continued to innovate and develop new technologies to maintain its competitive edge.

Industry Trends: The technology industry has undergone significant changes since 2005, with advancements in areas such as gaming, AI, data centers, and autonomous vehicles. NVIDIA has positioned itself well to capitalize on these trends, which has contributed to its stock performance.

In addition, you would have also received dividends from NVIDIA every quarter since 2012. The total amount of dividends you would have received from 2012 to 2024 is $15,487.97, based on the dividend history from Nasdaq³. Therefore, the total value of your investment, including dividends, would be $5,135,801.60 as of February 16, 2024. This means that your investment would have grown by 102,716% in 24 years, or by an average of 36.71% per year.

To put this into perspective, the S&P 500 index, which is a benchmark for the performance of the US stock market, had an annualized return of 7.64% from 2000 to 2024⁴. This means that if you had invested $5,000 in the S&P 500 index on January 3, 2000, your investment would be worth $32,759.66 as of February 16, 2024, including dividends⁴. This is a growth of 555.2% in 24 years, or by an average of 7.64% per year.